Tax and Business Measures

Federal

- Accelerated Investment Incentive – Dentists will be allowed to write-off capital assets (i.e. equipment, leaseholds, computers, software etc.) faster for purchases made after November 20, 2018.

Provincial

- Proposed new Low-Income Individuals and Families Tax Credit (LIFT) to eliminate provincial personal income tax for low income taxpayers with employment income starting in 2019.

- Annual Employer Health Tax (EHT) exemption is increasing from $450,000 to $490,000 starting in 2019.

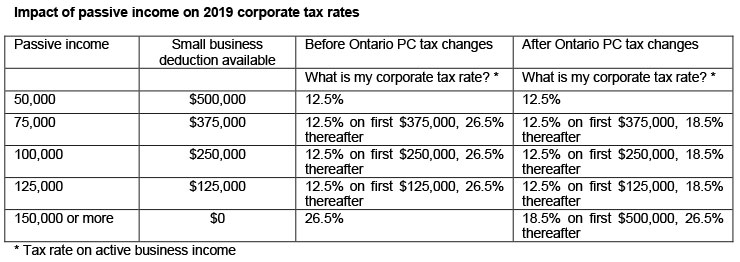

- Ontario will not implement the passive investment income rules which increase corporate tax rates where passive investment income exceeds $50,000.

- Proposed adjustments to personal tax rates in the 2018 Ontario Budget have been cancelled.

- Amendments to employment laws to clarify sick days, minimum wage and other changes.

What does this mean for you?

Accelerated Investment Incentive – Capital assets, which are written off over a number of years, will be written off up to three times as fast in the year of purchase. Previously a $10,000 autoclave, which would have resulted in a tax write-off of $1,000, will now receive a tax write-off of $3,000 in the first year. In year two, the tax write-off will be $1,400 (($10,000 – $3,000) x 20%) under the new rules.

LIFT – Low income family members could save up to $850 in provincial personal income taxes. To qualify, the taxpayer must have employment income. The potential tax savings (i.e. $850) is reduced where the taxpayer’s income exceeds $30,000 or the family’s income exceeds $60,000.

EHT – EHT is currently payable at a rate of 1.95% on salaries over $450,000 per year. The new rules mean the first $490,000 of salaries is not subject to EHT. For corporations that have salaries in excess of $450,000, this will reduce the EHT expense by up to $780 per year.

Passive income rules – Good news for dentists. Corporate taxes are made up of a provincial portion and a federal portion. The provincial tax portion will not be subject to the new passive investment rules. The federal tax portion will still be subject to these rules. Corporations that have passive investment income exceeding $50,000 per year (including those of associated corporations) could continue to defer up to $40,000 in provincial corporate taxes each year.

Adjustments to personal tax rates – Changes that were announced previously by the Liberal government have been cancelled. The proposed Liberal changes did not have a major impact on overall taxes. The cancelling of these changes has very little impact on dentists.

Amendments to employment laws: Certain changes that were implemented by the Liberal government have been replaced. In particular:

- Until 2020, minimum wage will remain at $14 per hour instead of $15 per hour.

- Workers will receive 3 sick days, 2 bereavement days and 3 family responsibility days. All days will be unpaid. Previously, workers were entitled to 10 personal emergency days with 2 being paid.

- Part time and casual staff will no longer be required to receive same pay rate as full time workers. OH

This summary was prepared by DCY Professional Corporation Chartered Professional Accountants who have been advising dentists/doctors for decades. Additional information can be obtained by phone (416) 510-8888, fax (416) 510-2699, or e-mail david@dcy.ca, basil@dcy.ca, eugene@dcy.ca, louise@dcy.ca. Visit our website at: www.dcy.ca. This article is intended to present tax saving and planning ideas and is not intended to replace professional advice.