There are very few certainties now, but we can be certain of the typical things: death and taxes. What about our life insurance premiums? With more and more Canadians living longer, wouldn’t this mean mortality costs should decrease? Not necessarily, especially as we dig deeper into government debt. There may be more at play as the Bank of Canada contemplates rate cuts in the future.

Dentists have a unique need for insurance as the majority are self-employed. They receive minimal employer benefits, if at all, so they primarily have to seek coverage themselves. Banks will often require life insurance within the financing process, and many won’t realize how these rates are calculated for them.

The life insurance industry, like many other industries, relies on interest rates. While they offer protection and security to you and your family when we’re gone, they must navigate enormous long-term risk as they allocate dollars towards reserve levels. These reserves are intended to secure the insurer against the existing mortality risk; perhaps a young person dies too early or a centenarian who just keeps going. In either event, an insurance company must prepare for the inevitable and certainty of death.

How do insurance companies manage risk, variability, or unknowns and certainties? It’s calculated risk vs. reward. However, with so much at stake, the government requires minimum capital for all insurers to ensure they’re properly capitalized to pay their policyholders’ beneficiaries.

Life Insurance Capital Adequacy Test (LICAT)

The Office of the Superintendent of Financial Institutions (OSFI) has set up a measure of how much capital an insurance company must have set aside. It sets out the minimum standards of stress testing and requirements for each insurer to ensure they are properly capitalized and ready for interest rate changes. OSFI looks at a variety of assets when determining how companies are capitalized, but first, it looks at the risk-free interest rates. In Canada, that means the Government of Canada’s Long Term Bond Yield (Fig. 1 and 2). Of course, there are many other factors at play, but when you factor in our current economic output and stress on markets, cracks begin to present themselves.

Fig. 1: Government of Canada benchmark bond yields from December 24, 2018, to February 27, 2024.

Life insurance companies thankfully prepare for these scenarios based on OSFI requirements. Not only do they prepare, but they also outright report to the public what may happen financially. For example, Sun Life Inc. (TSX: SLF).

At the end of 2019, Sun Life Financial Inc. disclosed that a 50-basis-point decrease in interest rates would have a negative $100 million effect on its net income. Additionally, if equity markets declined by 10%, its net income would decline another $100 million. Its 2019 net income was $2.62 billion.

Remembering again that insurers are protecting against long-term risks when individuals secure coverage, how did the interest rate policy of the time affect things?

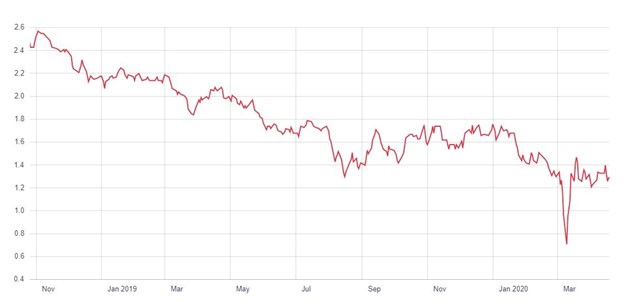

Fig. 2: Government of Canada benchmark bond yields from October 26, 2018, to April 17, 2020.

At the height of the pandemic, on April 20, 2020, Sun Life Financial Inc. raised insurance rates on a variety of long-term products between 5% and 27%. Whether it was a direct response to the above or a decision made months ago, a change was necessary.

Coming back to present times, at the end of 2023, Sun Life Financial Inc. stated: “Our results are sensitive to long-term interest rates given the nature of our business and to non-parallel yield curve movements (for example flattening, inversion, steepening, etc.).”

Although we can’t predict the future, we can certainly draw parallels from 2020 to 2024. Although insurance premiums may well change, insurance needs should take priority over potential price changes; speak to a professional advisor to learn more.

This information is general in nature and is intended for informational purposes only. For specific situations, you should consult the appropriate legal, accounting or tax advisor.

About the Authors:

Richard Lochhead, CIM, Portfolio Manager/Senior Wealth Advisor, Renn Financial Group and Joshua Fernando, Partner, Insurance, Renn Financial Group, leverage their experience and expertise to offer real opinions, practical explanations and unmatched service on financial strategies concerning Canadian dentists. Richard is a portfolio manager, car enthusiast and soccer fanatic. Joshua is an insurance expert and a former Canadian reality TV show contestant. Together they make up Renn Financial Group, a Canadian-based independent brokerage specializing in insurance, tax, and wealth.