Graduating from dental school can be bittersweet. You’ve climbed the mountain that is dental school and at the summit you find a taller mountain of debt and an avalanche of interest and bills to come. That’s the harsh reality for many dental school graduates. Overcoming this challenge isn’t impossible and can be made easier with a little bit of guidance. Here is our road map to being debt-free.

Step 1: Know the ins and outs of debt

Many graduates don’t know the details of their debts outside of the fact that they have a lot of it. Knowledge is power and understanding your student loans will allow you to tackle it much more effectively.

Here are the primary types of debt you may have after graduation:

- Government student loans

- Bank loan/line of credit

- Credit card debt

Government student loans – Student debt is made up of a federal portion (70%) and a provincial portion (30%), which have varying terms. The most important information to find out is 1) What is the interest rate? and 2) When do I have to make payments?

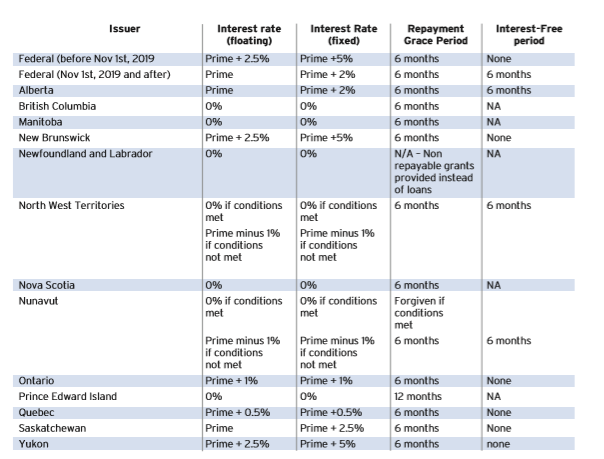

For the federal portion of your student loans, effective November 1, 2019 the interest rate being charged is prime (currently 3.95%). For the provincial portion, the interest rate varies with some provinces even providing interest-free loans.

With regards to the timing of repayment, both the federal government and all the provinces give you a 6-month grace period (after your graduation) before you start repaying, but not all the provinces give you an interest-free period. In Ontario, you don’t have to repay your student loans for 6 months, but they will still charge interest during this time. For provinces that provide interest-free loans, you still need to repay the loan on time as a condition to keeping your interest-free status.

The chart below summarizes the key loan terms and conditions for provinces and territories.

Bank loan/line of credit

Canadian banks generally provide student loans at prime interest rate. There are three differences between bank loans and government loans. First, there’s no grace period for interest on bank loans, interest is charged from the very first day you borrow the money even while you are in school. Second, you don’t get a tax break on interest on the bank loans like you do with government loans. Finally, bank loans may have a “revolving” feature. This means that if you repay $10,000 on Monday, but decide you want to buy a car on Tuesday, you can take out that $10,000 that you just repaid. This feature can help minimize your interest as demonstrated in the below example.

Using the revolving feature to minimize interest

The individual in both scenarios have the same net worth. The person in scenario 1 can show they have money in their bank accounts, but it’s coming at the cost of extra interest. On $50,000 at prime this would amount to almost $2000 a year in interest. In scenario 2, the individual is taking advantage of the revolving feature by reducing their loans to save interest. Even though they have no cash, if they need money in an emergency, they could always dip into their line of credit.

Credit card debt

Credit card debt is the worst kind of debt to have. If there’s one type of debt to avoid, it’s this one. There’s a reason credit cards provide so many incentives to entice you. The welcome rewards, points, cash back and low monthly minimums sound great but come at a cost if you are not disciplined. At 20% or more in interest, this is the debt you want to avoid at all costs. Using the revolving feature of your bank loans can help you pay off your credit cards in full every month.

Step 2: Prioritize your debts

Not every debt is the same, focus on those that are most costly first. Our recommended priorities are as follows:

Credit card debt – Pay off each month in full, even if it means borrowing to do so

Bank loans/line of credit – As the interest here doesn’t provide any tax relief and in general is the same or higher than government loans, this should be next on the list

Government student loans – With the reduction of interest rate on the federal portion to prime effective November 1st, these loans charge the same rate or less than bank loans/lines of credit and provide some tax relief on the interest paid. Hence, these should be considered last on the list.

Step 3: Maximize your income

Debt is not going to take care of itself without income. Consider the following when looking for an associate position:

Rural versus urban: Widening your geographical scope will make it easier to find a good associate position to hone your clinical skills and make money. Higher rents, higher operating costs and increased competition in urban areas means reduced working days/hours, less patients booked and fewer opportunities to provide more complex clinical procedures.

Collections policies: Many associates are paid based on collections, not billings. A practice that doesn’t collect co-payments, provides large discounts, can’t collect their receivables or uses a fee guide from many years past, means your take home pay gets proportionately smaller.

New versus established practices: New practices seeking associates often promote the opportunity to run your own practice and gain first hand experience on how to grow a business. For new dental graduates this means having to build up the patient base, less pay and less clinical exposure. You can’t expect to pay back your debts if you are not seeing very many patients. Look for an established practice with a healthy patient base so that you can further develop your clinical skills, receive mentorship and earn decent money.

Step 4: Invest in yourself

The best time to take continuing education courses is shortly after graduation. You may not want to step back into the classroom so soon, but losing a day of income now is small compared to losing a day of income when you are established. Adding these new tools to your tool box now also helps while you associate and gain more hands on experience which will let you pay off student loans much faster.

If you are clinically ready and confident, then look to buy your own practice. It’s possibly the fastest way to maximize your income and repay your debts. This will mean more debt, but it’s good debt to have as the value and risk it brings may out weigh the costs.

Step 5: Network

Success doesn’t happen without help. Build your social network which will enhance your financial success. Developing a rapport with classmates, dental suppliers, labs, accountants, lawyers, insurance professionals and bankers will be needed to enhance your personal and professional success.

Step 6: Delay gratification

The temptation to spend is everywhere. While you were in dental school, your friends and family were earning money, buying houses, cars, travelling the world and posting it all on social media. Now that you have graduated, it’s time to “catch up.” Trying to keep up with the Joneses is made even more difficult when the Joneses are now other more established dentists. When you go to study clubs, conferences and courses, you may see luxury cars lining the parking lot. Temptation is great to spend money on things which drop in value. This is when you start running someone else’s race.

Here are some tips to avoid overspending:

Automate your debt repayment: If your goal is to pay off your debts in 4 years and you have $200,000 in debt, you know you need to repay at least $4,167 in principal each month. Setup a preauthorized payment each month from your chequing account to pay off your loans. You can’t spend money that’s not in your account.

Set aside money for taxes: Most associates don’t have taxes withheld from their pay cheques. It’s easy to assume that the $15,000 cheque you just deposited is all yours since it has your name on it. Instead imagine it was written out to you and CRA, then setup a separate savings account to transfer 1/3 of your pay cheque. In other words, have two piggy banks, one for you and one for CRA. When tax time comes, you’ll be happy to have this separate piggy bank ready.

Track your expenses: The problem with budgets are that once you get off track, it’s easy to give up on your budget. Instead we ask that you keep track of your expenses. Start with the amount that’s in your bank account right now and add to it income you receive and subtract expenses you paid. At the end of the month the account balance should match your bank statement. There’s no pass or fail, it’s just an accurate account of what you made and what you spent. This will serve as a reminder of where you may have overspent on some things and hopefully help you scale back. Any improvement no matter how small is always a good thing.

Don’t view rent as a waste of money: The fear of missing out is a real concern in the housing market. Many people view paying rent as flushing money down the drain when you could be building up equity. This view doesn’t take into account the real costs of home ownership. Mortgage interest, land transfer tax, property taxes, maintenance, insurance and condo fees should be viewed in the same light as rent. These are all costs of home ownership that are “wasted”. Most homeowners only look at what they paid and what they sold their house for which embellishes the actual profits because it doesn’t take into account all the fees and costs paid during the time they owned the house. More importantly, they look past the biggest cost which is opportunity cost. What other investments did I give up to own this house?

For dentists, their best investment will likely be a dental practice. If you had $1 million dollars to buy a dental practice that generates you $200,000 a year or a house that saves you from paying $36,000 in rent, which would you choose?

Don’t let the house become an anchor preventing you for seizing other opportunities. Look to get your practice first, establish yourself, then buy a house. There may only be a handful of dental practices near your house, but there are likely hundreds of homes near your practice.

Transportation is a need, cars are a want: The first car you buy should be about transportation first. It’s to get you from point A to point B safely and reliably. Your next car after you’ve paid off your debts can be more in line with what you want.

Paying off debt isn’t easy, but its not impossible either. It will take discipline and focus, but a little sacrifice today means a much better tomorrow.

About The Author

This article was prepared by David Chong Yen*, CPA, CA, CFP, Louise Wong*, CPA, CA, TEP and Eugene Chu, CPA, CA of DCY Professional Corporation Chartered Professional Accountants who are tax specialists* and have been advising dentists for decades. Additional information can be obtained by phone (416) 510-8888, fax (416) 510-2699, or e-mail david@dcy.ca/louise@dcy.ca/eugene@dcy.ca. Visit our website at www.dcy.ca. This article is intended to present tax saving and planning ideas, and is not intended to replace professional advice.

This article was prepared by David Chong Yen*, CPA, CA, CFP, Louise Wong*, CPA, CA, TEP and Eugene Chu, CPA, CA of DCY Professional Corporation Chartered Professional Accountants who are tax specialists* and have been advising dentists for decades. Additional information can be obtained by phone (416) 510-8888, fax (416) 510-2699, or e-mail david@dcy.ca/louise@dcy.ca/eugene@dcy.ca. Visit our website at www.dcy.ca. This article is intended to present tax saving and planning ideas, and is not intended to replace professional advice.

RELATED ARTICLE: 5 Burning Questions For Dental Students & Associates